Your home is more than just a place to live; it’s a valuable investment that deserves protection. In this blog, we’ll emphasize the significance of Service Line Coverage and Water Backup Coverage—often overlooked aspects of home insurance. By understanding these types of coverage, homeowners can better safeguard their properties and financial well-being.

Service Line Coverage:

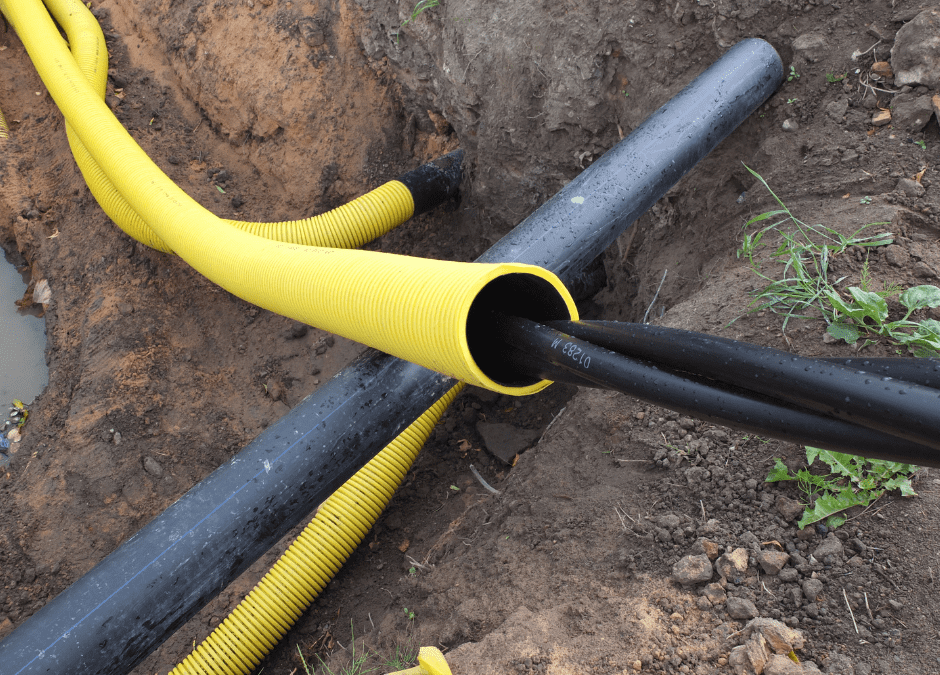

Service Line Coverage is designed to protect homeowners from unexpected repair costs associated with service line failures. These service lines can include water, sewer, gas, and power lines that run underground on your property. Here’s why it’s essential:

Costly Repairs: Service line failures can result in significant repair expenses. Damage to these lines can disrupt essential utilities, such as water and sewage systems, affecting your daily life.

Not Covered by Standard Policies: Many standard home insurance policies do not include coverage for service line failures. Without specific coverage, homeowners may have to bear these expenses out of pocket.

Comprehensive Protection: Service Line Coverage typically covers the costs of repairing or replacing damaged service lines, including excavation and labor expenses. This ensures that your property is restored to its normal functioning quickly.

Water Backup Coverage:

Water Backup Coverage is another valuable addition to your home insurance policy. It protects you from damage caused by the backup of water or sewage into your home. Here’s why it’s crucial:

Common Causes: Water backups can occur due to various reasons, such as blocked sewer lines, heavy rainfall, or a malfunctioning sump pump. The resulting damage can be extensive and expensive to repair.

Not Always Included: Many standard policies exclude coverage for water backup damage. Without this coverage, you might face substantial repair and cleanup costs.

Financial Protection: Water Backup Coverage provides financial protection against the costs of cleaning, repairing, and restoring your home in the event of a water or sewage backup.

By including Service Line Coverage and Water Backup Coverage in your home insurance policy, you can proactively protect your property and finances from the unexpected. While these coverages may involve an additional premium, they can save you significant expenses in the long run and provide peace of mind. Consult with your insurance provider to explore these options and tailor your policy to your specific needs. Remember, safeguarding your home is an investment in your family’s comfort and security.